Algorithmic trading is typically the realm of large hedge funds and banks. High trading fees and the need for armies of computer scientists and quants to build systems has kept algorithmic trading in the hands of the elite few. Today, our release of deephaven-ib brings algorithmic trading to everyone.

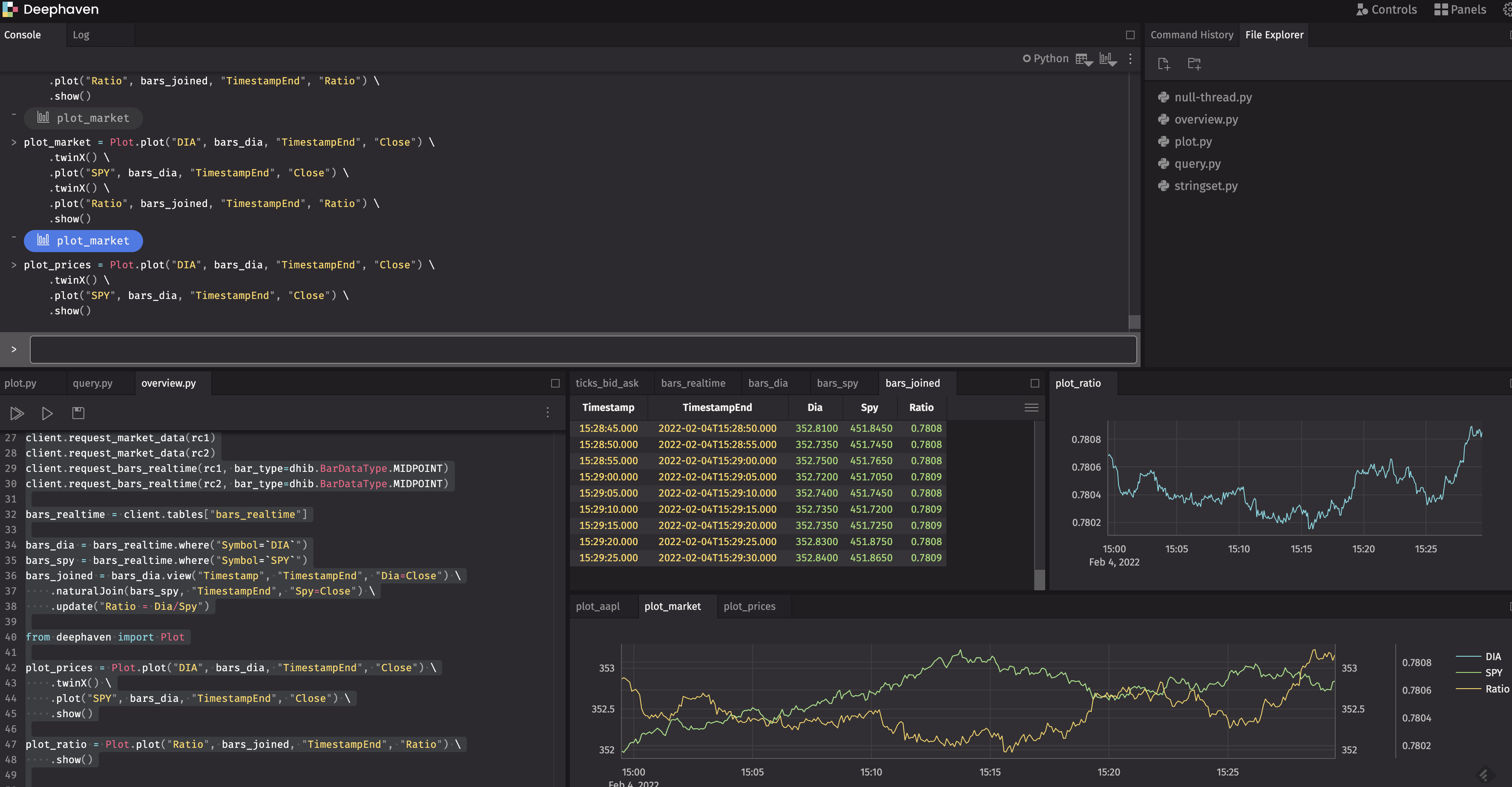

The deephaven-ib project allows you to combine the comprehensive infrastructure and low-cost trading of Interactive Brokers, the analytical capabilities and ease-of-use of Deephaven Community Core, and the ubiquity and power of Python to yield an open, real-time, quantitative trading platform.

Again: in real time!

The software provides a friendly, open platform for creating quantitative trading strategies, exploring data-driven opportunities, and creating custom analytics and monitors. You can build something simple, like a portfolio monitor, or something complex, like a fully-automated, multi-strategy quantitative hedge fund.

Deephaven Enterprise is the real-time query engine serving as the data-software backbone for the quantitative trading of some of the world's most significant hedge funds, banks, and exchanges. Deephaven makes working with real-time data simple and facilitates very concise and easy-to-read code. Quants develop new strategies and get them into production quickly; traders monitor the orders, opportunities, portfolios, and risk; and others model transaction costs and facilitate surveillance. Deephaven Community Core is an open version of the engine. It inherits identical capabilities, though has a more modular design and a more open-first API.

Interactive Brokers is a very popular brokerage in the quantitative finance world, with about $200B of customer equity. Quants and hedge funds often choose IB because of its low trading costs, its reach across geographies and asset classes, and a battle-tested API to facilitate automated trading. In 2021, Barrons ranked IB as the top online broker.

The deephaven-ib project supports trading essentially all common exchange-traded products. These include:

- Stocks

- Mutual Funds

- Options

- Futures

- Futures Options

- Indexes

- Bonds

- Foreign Exchange (Forex or FX)

- Cryptocurrency

- Contracts for Differences (CFDs)

- Warrants

- Commodities

If you want to trade momentum in Bitcoin, merger arbitrage in stocks, or volatility dispersion in options, deephaven-ib is there for you.

Also, if your trading ideas involve artificial intelligence, Deephaven's new learn library makes real-time AI/ML easy. You can build using any popular AI/ML library, including PyTorch, TensorFlow, and SciKit-Learn.

To find out more, see the deephaven-ib GitHub page at https://github.com/deephaven-examples/deephaven-ib. Also, stay tuned to the Deephaven Blog for examples that extend this project toward algorithmic trading, portfolio management, and analytics use cases.

Follow Deephaven on Twitter to stay up-to-date on our subsequent IB-related examples.

.jpg)